Medical cost in Singapore is on the rise and one of the first things I always address when I meet clients, is to ensure that they have a suitable hospitalisation plan in place to cover them in the event of admission to hospital.

With the recent changes and propaganda about the new Medishield Life, some of the common questions I have been asked a lot recently are “What does Medishield Life cover?” and “Why do I still need an Integrated Shield Plan?

So, I thought I would write a very short article, with a hope to help summarise briefly and concisely some of the essential information with regards to Medishield Life.

More information and answers to other questions can be found on the links mentioned below.

1) What is Medishield Life?

Medishield Life is a basic national insurance scheme run by CPF board payable by Medisave, and is an enhancement of the previous Medishield. It is an automatic inclusion plan for all Singaaporeans and PRs.

Medishield Life was recently introduced in Nov 2015 and is intended to provide:

- Better protection and higher payouts, so that patients pay less Medisave/cash for large hospital bills

- Protection for all Singapore Citizens and Permanent Residents, including the very old and those who have pre-existing conditions

- Protection for life

2) What does Medishield Life cover?

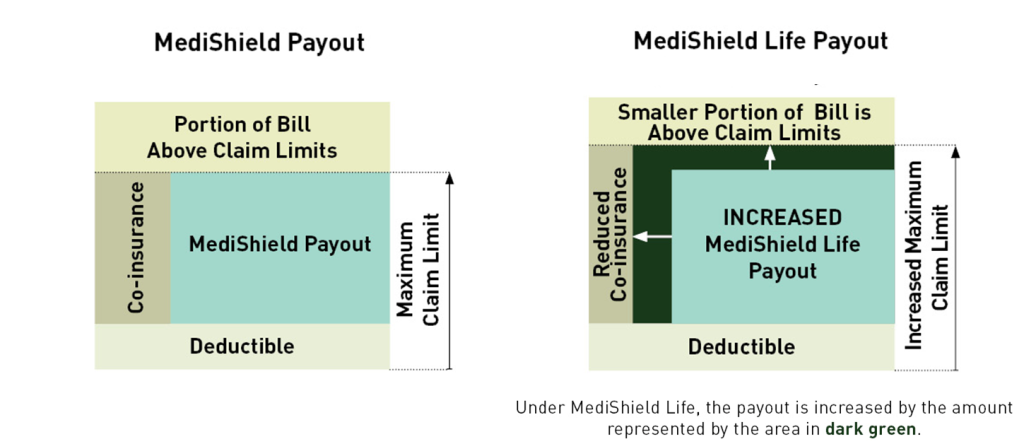

Medishield Life has been enhanced from Medishield with coverage extended to cover all pre-existing conditions, provide higher claim limits and lower co-insurance.

This is illustrated below:

*Source: www.moh.gov.sg

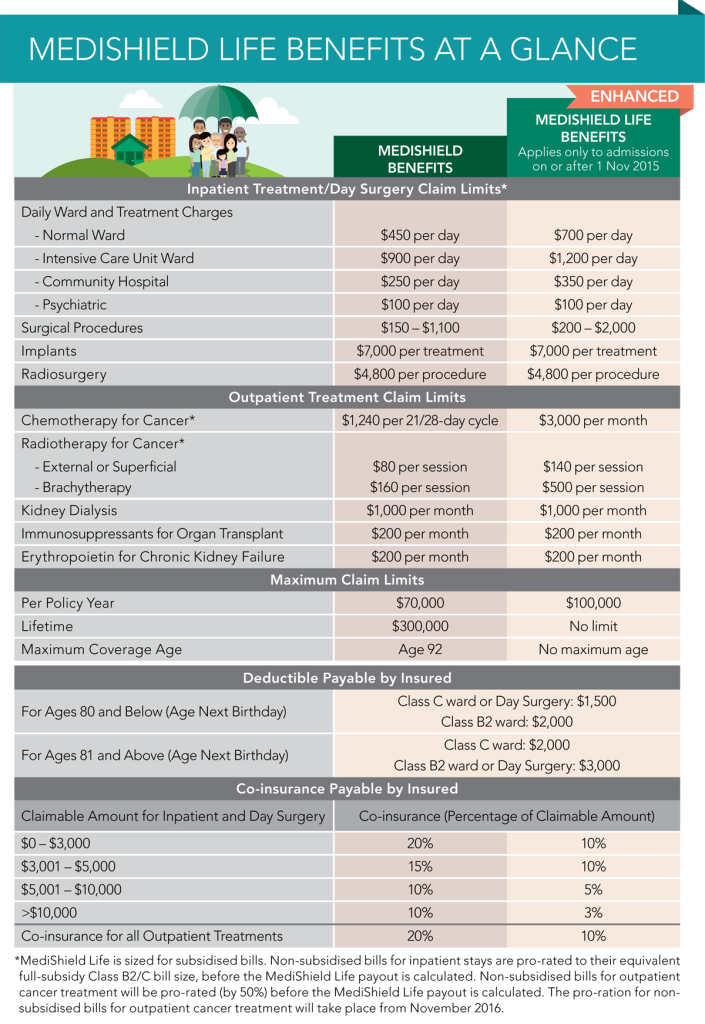

More detailed benefits of the enhanced Medshield Life are shown in the table here:

*Source: www.moh.gov.sg

Medishield Life is catered to provide coverage for large bills for patients who are comfortable seeking treatment at subsidised wards at restructured hospitals (eg. TTSH, NUH, KTPH, SGH).

What are subsidised wards?

Subsidised wards are B2 or C wards in restructured hospitals. B2 wards are mostly 5 or 6-bedder and non airconditioned, while C wards are mostly 8- or more bedder and non-airconditioned, both with shared bathrooms. At subsidised wards, patients do not get to choose their attending physician and access to services may bit a bit slower compared to private patients.

Note: It is important to note that if a patient insured under Medishield Life chooses to stay in Class A/B1 wards or private hospitals, his MediShield Life claim will be calculated based on a pro-rated percentage of his hospital bill. In other words, there will still be a large part of the hospitalisation expenses that will not be covered by Medishield Life and which will have to be paid from cash and/or Medisave.

3) Would I still need an Intergrated Shield plan?

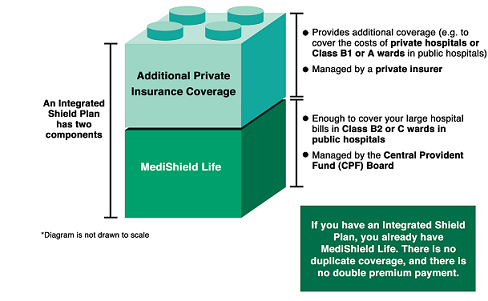

An Integrated Shield Plan is a plan underwritten by a private insurer which provides additional coverage above and beyond what Medishield Life provides.

Below is a diagram which shows how an Intergrated Shield Plan works with Medishield Life.

*Source: www.moh.gov.sg

Most Integrated Shield plans provide “As charged” benefits, higher limits as well as other benefits such as pre- and post- hospitalisation coverage which Medishield Life does not provide.

If you would like the option for higher claim limits and the option to stay in B1 and above wards, or private hospitals, an Integrated Shield plan would be a plan you should purchase if you have yet to do so.

As there are different types of Integrated Shield Plans, do speak to your financial advisor to review your existing hospitalisation coverage and ensure that you are sufficiently covered with a suitable hospital plan.

4) Why have premiums of my Integrated Shield Plan gone up?

With the enhanced benefits and coverage of Medishield Life as well as increased claims experience over the years, premiums have gone up. Since Integrated Shield Plans incorporates Medishield Life, premiums have also risen.

The government has provided several types of subsidies to help ease the transition in premiums over the next few years.

I hope the above has provided a quick snapshot of Medishield Life.

The image below provides a very good summary about Medishield Life.

If you still have questions regarding Medishield Life, these two websites provide very comprehensive answers 🙂

www.moh.gov.sg

www.straitstimes.com